NSEA engaged at yesterday’s meeting of the K-12 Budget Subcommittee, asking the committee to reject the Governor’s proposed $2 budget. Instead, we called on the Governor and Legislature to Pass the Plan offered by the Commission on School Funding to reach optimal education funding. After years of work, the Commission identified optimal funding and proposed a revenue path to reach that level by 2035. To increase education funding by about $2.5 billion over the next 10 years, the Commission recommends reforming property tax abatements and depreciation, while expanding the base on the sales tax.

The only section of the Commission’s 534-page document that contemplates tax abatements is Exhibit F, an investigation of tax credit school voucher programs. The only consideration of the film industry is a recommendation to extend the sales tax to the downloading of digital movies.

The Commission on School Funding is a serious body and has taken a professional and methodical approach to their mission. They have not recommended a film tax credit or any other enticement of industry to improve the funding of our schools. That’s likely because tax credits just don’t generate new net revenue. This is particularly the case for film tax credits. Study after study shows that film tax credits, whether for an existing industry or to lure studios or production to a new location, cost more than they bring in. In California, the Legislative Analyst Office found that California had made 65 cents for every dollar spent on film tax credits. An audit conducted for New York State’s Department of Taxation and Finance found their film tax incentives only produced 31 cents in direct and indirect revenue for every dollar spent. Meanwhile, Georgia has built a significant film industry with the lure of tax credits. However, the Georgia State University Fiscal Research Center found that Georgia only saw 19 cents of revenue for every dollar the state spent.

Sadly, there has been a fundamental contradiction in the actions of Nevada leaders when it comes to properly funding public education and other vital state services. While nearly every elected official claims to prioritize education, there’s a competing record of corporate giveaways, from Tesla to the Raiders, that cost the state over a billion dollars. Immediately after last session, the Governor convened a special session to give billionaire John Fisher $380M in public money to build a baseball stadium in Las Vegas. A majority of legislators voted to approve the proposal.

The effects are real. According to the Economic Forum’s December projections, Nevada is estimated to lose $119M in general fund revenue to tax credits this year. That goes up to $143M next year, assuming the A’s build their stadium. In the out year it rises to $157M. Those are funds that otherwise could be going to important services, including education. Imagine taking away another $100M/year.

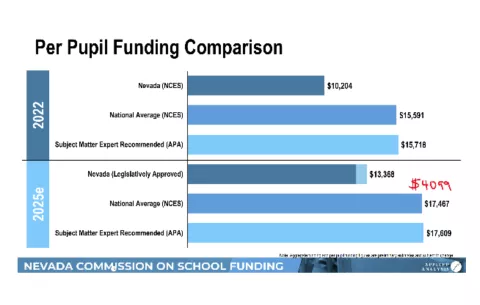

During last session, NSEA and our allies pointed out Nevada was the only state in the country to receive 3 Fs in education funding in the 2023 “Making the Grade” report released by the Education Law Center.

Even with record increases made to education funding, Nevada still trailed the national average by $4099 per pupil. In May, 1000 educators and allies rallied with umbrellas in hand outside this building, pleading for more consideration for education. Instead of doing more, SB1 was passed for the A’s.

In response, NSEA launched Schools Over Stadiums. While we haven’t yet stopped those subsidies in the streets or the courts, we have succeeded in generating a ridiculous amount of coverage, turning the tide of public opinion. In an Emerson College poll of likely Las Vegas voters in 2024, 52% opposed the use of public money for the construction of a baseball stadium. Only 32% were in support. That’s 20 points underwater. Now with Schools Over Studios, NSEA is committed to continuing our efforts to make sure Nevada’s priorities line up with the people.

We urge legislators to reject AB238 in the strongest possible way. Meanwhile, we hope that the Revenue Committee will give full consideration to the revenue proposals put forward by the Commission on School Funding. Please, Pass the Plan.

Learn More

What's On Your Mind?